The 2024 landscape of outsourced finance and accounting services is transforming due to advanced technologies, market evolution, and strategic cost considerations. AI and automation are streamlining operations and enhancing data management and compliance, improving efficiency and decision-making in financial services. The rise of hybrid models integrates outsourced services with in-house operations, optimising cost efficiency and operational flexibility.

What is finance and accounting outsourcing?

When a business outsources its accounting, it essentially transfers responsibility for some or all of its accounting tasks to a third-party accounting firm. Before you can start thinking about how outsourced accounting might benefit your business, it’s crucial to understand exactly what outsourced accounting is (and isn’t). We give you your time back, so you can build your business knowing your books will be accurate and you can use financial data to help you grow. As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity. Trained accountants can spot red flags ahead of time and notify you about things like cash flow discrepancies. Second, freelancers are usually contracted workers who are hired to help balance your books, while firms are dedicated accounting companies that solely focus on that goal.

- With AI increasingly targeted by cyber-attacks, companies must prepare for potential breaches.

- Freelance bookkeepers collaborate one-on-one when it comes to bookkeeping and accounting needs.

- It leaves room for everyone in-office to be solely focused on their own tasks and can eliminate the cost of an in-house bookkeeping team.

- Determine how much you are willing to invest in outsourcing, keeping in mind that quality and reliability should be prioritized over low-cost providers.

- The typical cost for outsourcing bookkeeping, accounting, and similar services ranges from $500 to $5,000 per month.

What are the benefits of outsourcing finance and accounting?

These technologies generate consistent, timely financial reports and adapt to regulatory changes in real-time, crucial for companies operating internationally. Learn how to overcome the accounting staffing crisis from the CEO of the company leading the outsourced accounting movement. Since Merritt Bookkeeping has no setup charges or transaction limits, you can definitely give it a try until you need more advanced bookkeeping services.

Free up time

Work with a bookkeeping outsourcing services provider who is SOC 2, GDPR certified and further strengthens its cybersecurity posture with other certifications that prove that your data is safe. The QXAS objective is to take up the burden of time-intensive tasks to give your accounting firm the benefit of labor cost arbitrage savings and technology transformation. Leverage our bookkeeping outsourcing services to do more, earn more, and all this without getting overwhelmed. Customized reports and dashboards allow businesses to focus on relevant metrics and key insights directly impacting their growth strategies.

By having a clear picture of their financial health, businesses can make proactive decisions that align with their growth objectives and position themselves for success. Additionally, automation enables seamless integration between various financial systems and processes, enhancing data accuracy, and facilitating real-time analysis. Businesses can access up-to-date financial information, track key performance indicators, and identify trends and patterns that inform strategic decision-making. Before finding the right bookkeeping service for your business, it is crucial to assess your specific needs and budget. By understanding the scope and requirements of your bookkeeping tasks, you can find a service provider that aligns with your business goals and objectives. Working with an outsourced CFO offers business leaders the opportunity to access this financial expertise at a fraction of the cost of hiring a full-time CFO to work for their business.

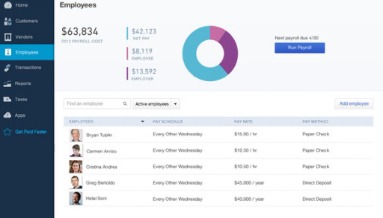

Whether you are starting a career or seeking a change, start building job-ready skills in bookkeeping and accounting with Intuit’s Bookkeeping Professional Certificate and Bookkeeping Basics on Coursera. In these programs, you can learn accounting principles, accounting software, payroll, how to prepare financial statements, and more. Its professional services include month-end financial reporting, tax advisory, and monthly bookkeeping.

Firms and freelancers can be local or virtual, though most bookkeeping firms will opt for a virtual system over a physical one. First, local bookkeeping is usually done with pen and paper, while virtual bookkeeping takes this service into the digital realm. When your business needs outgrow the solutions we’ve covered, it probably means you need to grow your accounting department and employ an in-house bookkeeper. MicroSourcing ensures your data is secure and meets outsourcing compliance standards.

The Premium plan ($399 a month if billed annually or $499 billed monthly) adds tax advising services, end-of-year tax filing, and financial strategy planning. The American Institute of Professional Bookkeepers offers certification for experienced bookkeepers. You will learn how to record costs, value inventory, calculate depreciation, analyze financial statements, and use software programs. The courses cover bookkeeping, Microsoft Excel, business math, and payroll administration. The strategic importance of finance and accounting outsourcing (F&A) is increasingly vital for businesses aiming for efficiency and expertise amidst global economic changes.

That means you won’t get to spend as much face-to-face time with your accountant as you would if they were your employee. If you’re bringing in an outsourced controller to help manage your existing team, it’s necessary to carefully consider what this relationship will look like. cpa pep admission requirements for holders of undergraduate degrees If you’re the type of person who likes to shake someone’s hand and look them in the eye, the remote nature of outsourced accounting may require some adjustment. This is not a complete list of benefits that businesses can expect when partnering with an outsourced accounting firm.

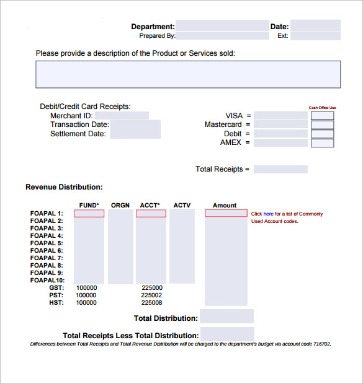

You will check bank deposits for fraud, fix balance sheet errors, and maintain accurate payroll records. As a bookkeeper, you will verify and balance receipts, https://www.accountingcoaching.online/classified-balance-sheet-financial-accounting/ keep track of cash drawers, and check sales records. Bookkeepers also deposit money, cash checks, and ensure correct credit card transactions.

Outsourced accounting firms work with a wide range of clients, many of which may also operate in your industry. Their teams live and breathe accounting every day, and will replicate best accounting https://www.adprun.net/ practices from across your industry into your business’s workflows, boosting efficiency and productivity. Because accounting can be so complex, it’s often pushed to the back burner.